As a nonprofiteer, you're all about changing the world. You're saving the sloths, building homes for the houseless, and curing the climate crisis. But while being a crusader for justice sounds pretty action-packed on paper, the reality is a bit less glamorous. In fact, one of the most important facets of a healthy nonprofit organization is good nonprofit accounting practices. Yep, success lies not in rescuing pygmy hippos from burning buildings (a crucial task, of course!) but in tallying numbers and balancing books.

No matter how good the fight, you need to start with sound finances, so you can build a better world on a sturdy foundation. Wondering how to do that? Join us on a magically practical and practically magical journey through the world of nonprofit accounting.

What is nonprofit accounting?

Beyond the obvious (it's accounting but for nonprofits is not an explanation!), nonprofit accounting refers to keeping track of all of your nonprofit organization's financial goings-on to ensure transparency and accountability.

And why are sound accounting practices important for nonprofits?

So, yeah, while we'd all love to spend our days doing the hands-on, superhero work we love, financial health creates a healthy nonprofit, and sound accounting practices ensure you stay on budget and above board. With your books all in order, you can accurately track and report on overhead expenses, revenue sources, and use of funds, instilling confidence in your many stakeholders through transparency and accountability. Additionally, good accounting practices mean more informed decisions, better resource management, and compliance with any legal and regulatory requirements. And ultimately, that ensures you can make the most of every penny to serve your mission.

How nonprofit accounting differs from for-profit accounting

Now that we're all on the same page re: nonprofit accounting, let's dig into it. A nonprofit's main goal in life is to provide services that improve lives and better the world. That's pretty different from for-profit companies, which aim to make money and serve their shareholders. As such, it's no surprise that nonprofit accounting is pretty darn different from regular accounting.

Basically, nonprofits need to focus on accountability over profits. As a nonprofit, you're about people over profits—quite literally. You have no shareholders and no owners. And that's why nonprofit accounting emphasizes transparency and accountability to donors and stakeholders. As a result, nonprofits need to undergo regular internal audits and submit key tax forms and financial statements to prove funds are funding their mission and making the world a little bit brighter.

More specifically, they need to …

- Use fund accounting. While for-profit orgs can track and report on their overall financial performance all willy nilly (okay, not quite, but kinda-sorta!), nonprofits need to distinguish between different fund categories. That way, they stay accountable to their funding sources by keeping track of the various donor restrictions and grant designations inherent in different types of funds. For instance, if you receive a grant that's restricted to knitting hats for mongooses, fund accounting ensures every cent of that grant gets allocated to your mongoose outerwear program.

- Get those financial statements in order. Nonprofit financial statements—similar, but not exactly bank statements—are reports that demonstrate how everything's going in terms of your moolah. The four key financial reports include a statement of activities, statement of financial position, statement of cash flows, and statement of functional expenses. That's pretty jargon-y, so we'll get back to those shortly with some more details.

- File a Form 990. Great news: You don't need to pay taxes as a nonprofit! But you still need to do some work come tax season if you want to keep that tax-exempt status. Enter Form 990, which is all about keeping nonprofits honest. It's basically an organizational overview, and once you've filed it, it's a public document, which means anyone can view it—donors included.

How nonprofit accounting differs from nonprofit bookkeeping

Let's dive deeper into the captivating world of nonprofit accounting and unravel the intriguing distinction between accounting and bookkeeping in the nonprofit world. Bookkeeping and accounting may seem similar at first glance, but don't be fooled! These two concepts are actually worlds apart, and grasping their distinctions will revolutionize the way you delegate responsibilities within your team—and the way you budget for impact.

Here are the key differences between nonprofit accounting and nonprofit bookkeeping:

Nonprofit bookkeeping involves the maintenance of daily financial records for your nonprofit organization. Examples of tasks completed by your nonprofit's bookkeeper include:

- Inputting data

- Recording one side of transactions

- Processing payroll

- Allocating expenses

- Writing checks

- Making deposits

Nonprofit accounting, on the other hand, involves the compilation of reports and analysis of key information to support strategic decision-making. Some of the tasks performed by a nonprofit accountant include:

- Reviewing accounts

- Understanding the purpose behind decisions

- Preparing reports

- Preparing for an audit

- Filing your Form 990

- Reconciling accounts

- Ensuring GAAP standards are met

Bookkeepers and accountants have different educational requirements. While bookkeepers typically don't need specialized education, it can be beneficial. On the other hand, accountants usually need at least a four-year degree and may also have a fancy CPA license.

These positions are the backbone of your organization, but they should never be mashed into one. While a dedicated volunteer or staff member might excel at managing the books, crunching numbers like an accountant just isn't their cup of tea.

A nonprofit's 2 essential financial documents

- Form 990

- A budget!

Importance of IRS Form 990

The IRS Form 990 is like a superhero cape for nonprofit accounting teams, helping them maintain their tax-exempt status and save the day with the federal government. Some states even require a copy to make sure organizations are nailing their state charitable registration requirements.

At its core, your Form 990 is a public financial document that shows how your non-profit organization has spent money.

Completing this tax form isn't just about following the rules—it's about boosting your nonprofit's credibility and wooing potential donors. With your Form 990 in hand, you'll be showing off your organization's transparency and proving that you're a master at making every dollar count. Many donors—especially major donors—make it a point to hold nonprofits accountable through their 990s.

Nonprofit budgets FTW

Your nonprofit's budget is like a financial compass, leading you through the twists and turns of expenses and projected actual revenue for the year. It's not just a document that gathers dust, but a dynamic tool that you'll consult time and time again, keeping your organization on track and adapting to its ever-evolving needs.

To maximize the impact of your nonprofit's budget, your organization must:

- Specify how you will use nonprofit funds.

- State your expected income and expenses.

- Set practical goals and metrics for your budget plans.

Organizations often have multiple budgets throughout the year, including an annual budget for overall activities and shorter-term budgets for specific events and campaigns. It is important to regularly review and update the annual budget based on the actual expenses and revenue generated from these shorter initiatives.

The 4 must-know nonprofit financial statements

It's not the same as a bank statement! If you want to keep your nonprofit organization running smooth and sure, these four statements will simplify your financial activity tracking and help you make data-driven (and budget-minded) decisions in the year ahead.

- Statement of activities

- Statement of financial position

- Statement of cash flows

- Statement of functional expenses

1. Statement of activities

An income statement provides detailed information about a business' financial performance—what they're making, what they're losing, what they're spending, etc., etc., etc. But because nonprofits are focused on their mission over profits, they instead use a statement of activities. This document breaks down your revenue streams and your expenses by classification (fundraising expenses, office supplies, and so on), so you can determine your net assets and ensure you're staying on budget.

2. Statement of financial position

For businesses, a balance sheet is a key financial statement that shows aaallll the things they own that can be distributed to shareholders. But nonprofits have nary a shareholder, so they use a statement of financial position. It's basically the same as a balance sheet, showing assets (what you own), liabilities (what you owe), and net assets (total value) to provide a clear picture of your financial health. The one difference is that it includes separate lines for restricted funds.

3. Statement of cash flow

This one is pretty much the same for nonprofits and for-profit businesses. It summarizes where cash is coming from and where it's going, helping to determine if you cash management is effective and efficient, much like a free-flowing river. The statement of cash flow has three main sections: cash flows from operating activities, cash flows from investing activities, and cash flows financing activities.

4. Statement of functional expenses

Finally, this financial report is exclusive to nonprofits (wow, we feel so special!) and outlines your organization's expense tracking based on three categories: program services, management and general administration, and fundraising. It shows how resources are allocated across different areas to help you and your stakeholders understand how money's being used.

Best practices in nonprofit accounting

With all those crucial details and differentiators out of the way, you're ready to manage your finances efficiently and effectively by getting your nonprofit accounting in tip-top shape. Here where to start.

- Get nonprofit accounting software

- Make sure everything integrates

- Use fund accounting

- Follow your rules

- Listen to the pros

- Build budgeting strategies

- Comply with state reporting mandates

- Perform regular audits

- Discover the benefits of automation in financial management

Get nonprofit accounting software.

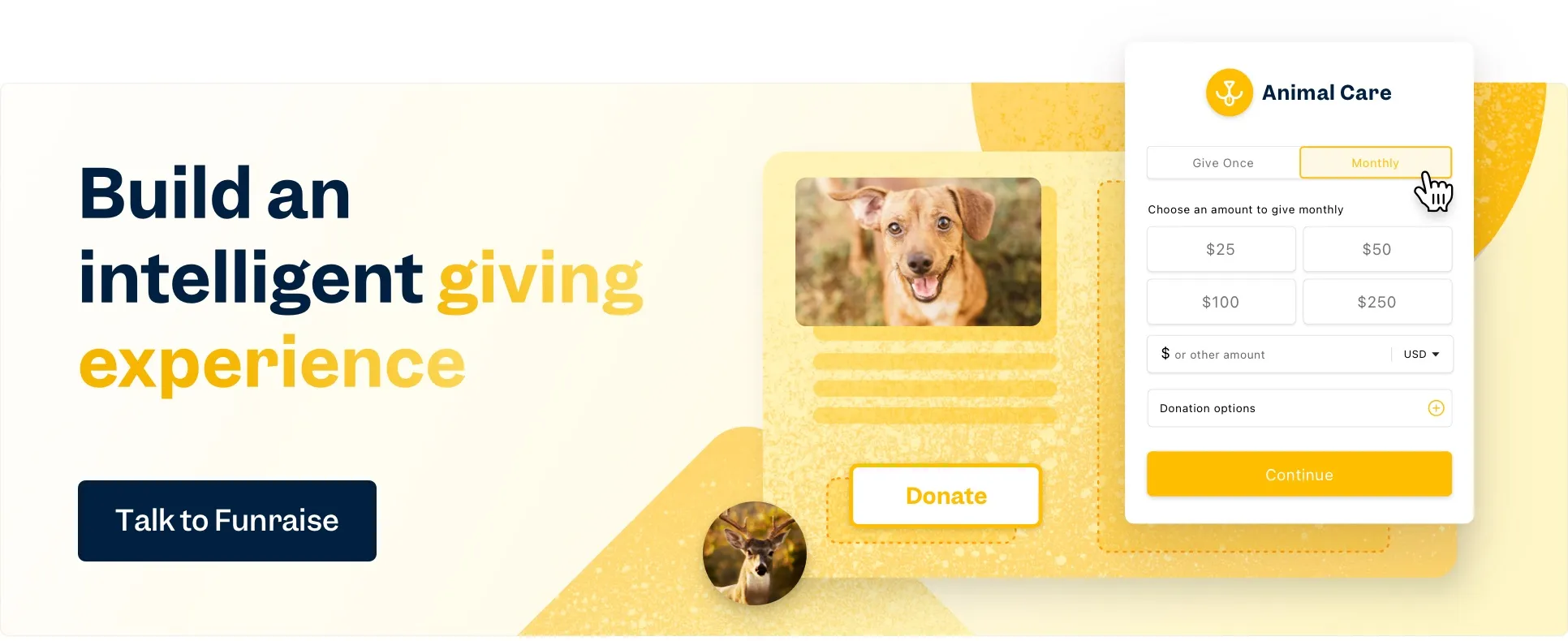

Just like you should use a nonprofit CRM (we've got you covered there!) to optimize fundraising and foster relationships through donor management, you want business accounting software tailored to nonprofit financial needs. So, get thee to an accounting software program that knows nonprofit financial management like the back of its (nonexistent) hand.

Ensure you have the integrations you need.

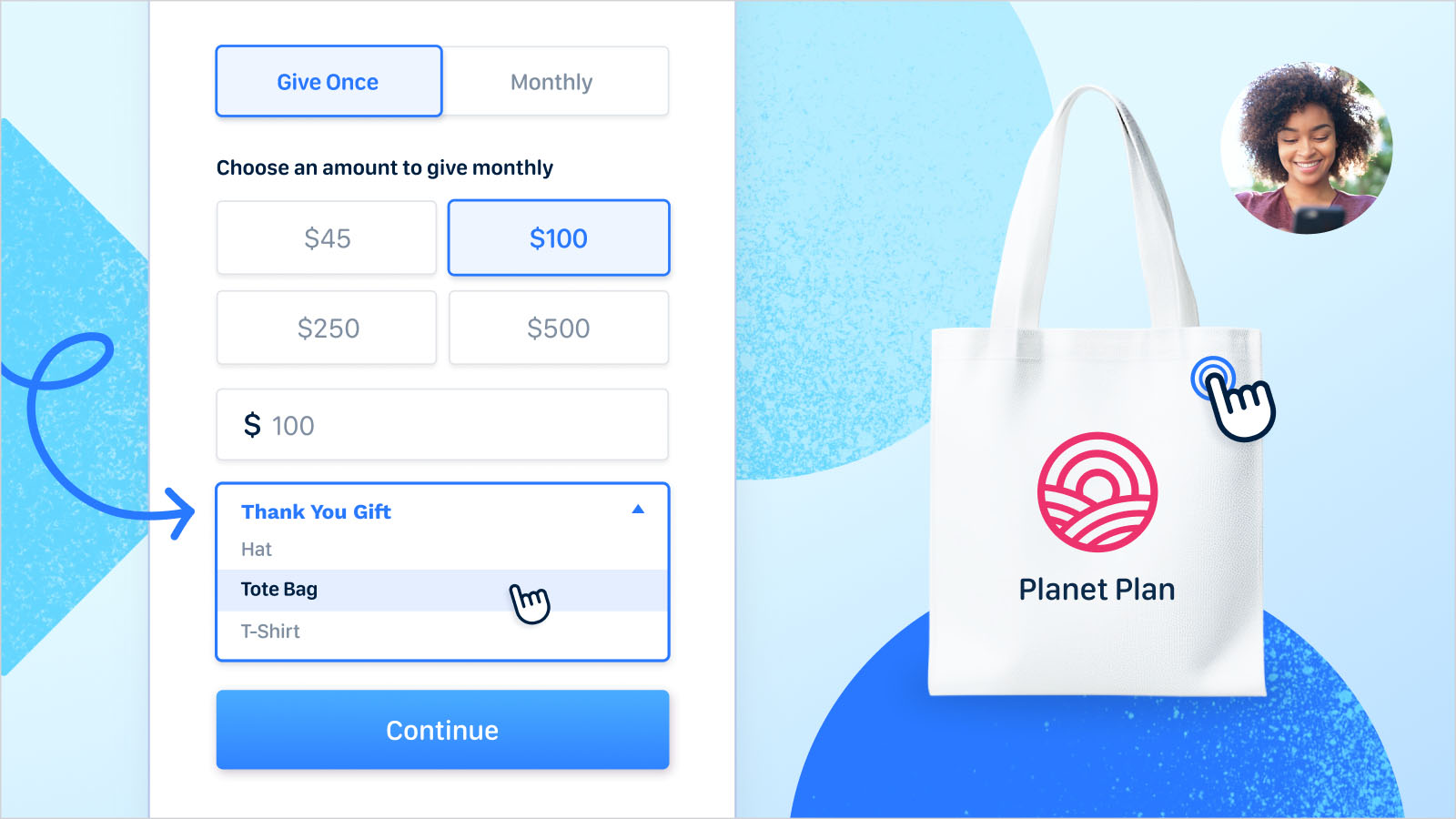

Make your life as easy as possible by using a fundraising platform that integrates with your go-to accounting software. Psst, did you know Funraise integrates seamlessly with QuickBooks and Salesforce? ‘Tis true—you can send offline Funraise data to QuickBooks in a flash and send data to Salesforce to access advanced reporting and automations!

Remember to use fund accounting.

As we've discussed, nonprofits need to use fund accounting to keep track of different funding sources and their respective designations for specific purposes. This way, you'll make sure all your resources are appropriately allocated and all your reporting is totally transparent.

Establish internal controls.

Nonprofit accounting rules are all about that accountability, so you'll want to establish internal controls to prevent fraud and ensure everything is by the book. How do you do that? Regular financial reviews, clear approval processes for expenses, and, of course, secure software.

Leave it to the professionals.

Nonprofit accounting isn't easy, and sound accounting principles now can mean more money for your mission in the future. If you lack expertise in nonprofit accounting and you can swing it, bring in an accounting firm. You can consult with a full-time accountant or hire a nonprofit finance specialist to keep your accounting services running smoothly and ensure everything's in compliance.

Build budgeting strategies.

Effective budgeting is crucial for nonprofits to align their financial resources with their mission and goals. Develop a flexible budget that can adapt to changing circumstances, and involve key stakeholders in the budgeting process. Remember to categorize expenses, include non-monetary contributions, and focus on cash flow to create a comprehensive financial roadmap.

Establish internal controls.

Internal controls start by setting a strong control environment from the top down, emphasizing the importance of following policies consistently. Key internal controls include segregation of duties, proper authorization of expenses, and regular independent reviews of financial processes. By establishing robust internal controls, nonprofits can protect their assets, ensure accurate financial reporting, and maintain donor trust.

Comply with state reporting mandates.

Funraise CEO and Co-founder, Justin Wheeler, says it pretty well:

We've seen firsthand how crucial compliance is to nonprofit fundraising, specifically for nonprofits that raise money online. Online fundraising means your reach extends far beyond your local community, but here's the thing... while these laws are complex, compliance isn't optional. As nonprofits, we don't stop at avoiding penalties; we prioritize building trust with donors and demonstrating our commitment to transparency.

Using a nonprofit fundraising software like Funraise in conjunction with a nonprofit compliance specialist like Harbor Compliance means that you've got every "t" crossed and every "i" dotted.

Do regular audits.

A few states (and certain government agencies) require nonprofits to submit an independent audit, but generally, nonprofits are exempt from this fun activity. Still, we're gonna suggest you participate regularly even if it's not a requirement. Conducting periodic internal or external audits will help keep your finances on track and identify any potential issues or areas for improvement.

Discover the benefits of automation in financial management.

Automation is revolutionizing nonprofit financial management, offering numerous benefits. By implementing automation in areas like accounts payable, donor management, and grant tracking, nonprofits can streamline operations, reduce errors, and improve efficiency.

Automated systems provide real-time access to financial data, making it easier to generate transparent reports for donors, board members, and auditors. Additionally, automation can help nonprofits track restricted and unrestricted funds more effectively, ensuring compliance with donor intentions and tax-exempt status requirements.

Understanding Overhead Costs

Overhead costs are often misunderstood in the nonprofit world. If you've heard of the Overhead Myth, you know exactly what we're talking about. It's nonprofits being excoriated for paying competitive salaries to their staff or replacing wildly out-of-date computers.

While some donors may focus solely on program expenses, enlightened supporters recognize that investing in overhead is crucial for a nonprofit's financial health and mission fulfillment.

And if you know Funraise, you know that we're pushing back on the Overhead Myth every day—nonprofits need access to the best tools, team, and technology so they can do the work that makes us all better, every day.

Importance of Sustainability

Sustainable nonprofits understand that proper overhead spending is key to organizational effectiveness. By allocating resources to areas like staff development, technology infrastructure, and fundraising capabilities, nonprofits can enhance their ability to deliver services and attract funding. This investment in operational capacity allows organizations to scale their impact and respond to changing community needs more effectively.

Strategies for Managing Overhead

Effective management of overhead costs is critical for nonprofit financial health. One strategy is to segment overhead expenses into categories such as occupancy, labor, and other operational costs. This approach allows organizations to isolate controllable short-term expenses from longer-term fixed costs, enabling more precise management and adjustment when necessary.

Nonprofits can also leverage technology and automation to reduce administrative costs and streamline operations. Implementing efficient systems for donor management, accounting, and program tracking can significantly cut down on overhead while improving overall organizational effectiveness. Additionally, developing a strong volunteer program can help offset certain overhead costs by engaging skilled volunteers in tasks that might otherwise require paid staff.

Hiring vs. Outsourcing Accounting Services

Do nonprofits need an accountant? That is the question.

Most organizations with charitable or nonprofit status don't have the resources to hire a full-time accountant. But, as we've learned, nonprofit bookkeeping—and a tax-exempt status—is no easy task, so the question is whether you should hire a CPA (that's certified public accountant) to ensure accuracy and accountability when it comes to your finances or whether you should outsource accounting tasks.

Which option will help you keep that nonprofit tax-exempt status you worked so hard to earn?

Pros and Cons of Hiring In-House

Hiring in-house accounting staff provides nonprofits with direct control over financial operations and immediate access to financial data. This approach can be beneficial for organizations requiring real-time financial decision-making and those with complex, organization-specific accounting needs. In-house accountants develop a deep understanding of the nonprofit's mission and financial structure, potentially leading to more tailored financial strategies.

However, maintaining an in-house nonprofit accountant comes with potential drawbacks. The costs associated with salaries, benefits, training, and office space can strain a nonprofit's budget. Additionally, relying on a small in-house team may limit access to specialized expertise in areas like nonprofit-specific regulations or advanced financial analysis. There's also a risk of reduced financial oversight, as having a single person or small team handling all financial matters can potentially lead to errors or oversights. (Although we're sure your accountant is the bomb.)

Benefits of Outsourcing Accounting Functions

Outsourcing accounting services offers numerous advantages for nonprofits. Cost-effectiveness is a primary benefit, as organizations can access a team of experts without the overhead costs associated with full-time employees. Outsourced accounting firms often provide specialized nonprofit expertise, ensuring compliance with sector-specific regulations and best practices in areas such as fund accounting and grant management.

Another significant advantage is the enhanced financial reporting and transparency that comes with professional accounting services. Outsourced firms can provide timely, accurate financial reports crucial for donor trust and board oversight. Additionally, outsourcing introduces improved internal controls, reducing the risk of financial mismanagement. This approach also allows nonprofits to scale their accounting services as needed, providing flexibility as the organization grows or faces changing financial complexities.

Tools to effectively manage your nonprofit finances

Finally, here are some tools to help you stay on top of all your basic accounting functions.

- Funraise Payments

- A Customer Relationship Management (CRM)

- A Finance Committee

- Nonprofit accounting software

- Financial reports and dashboards

1. Funraise Payments

Funraise has it all—and we mean alllllll—when it comes to building a successful nonprofit, combining everything from donation management and event registration to advanced reporting and recurring giving tools. And with Funraise Payments, you can streamline payment collection for donations, fundraising events, or membership, managing financial transactions efficiently and easily. With our air-tight payment processor that accepts all your donors' favorite payment methods (bank accounts, Venmo, and stock—oh my!), donor management and financial management is a breeze.

2. A stellar CRM

Finances and donors go together like ice cream and hot fudge, like pizza and ranch dressing—an irresistible combo, if you ask us. And a single-solution software for nonprofits like Funraise can help you do it all when it comes to your fundraising, facilitating donor stewardship, improving fundraising efforts, and enhancing your donor relationships. With all that info in one place, getting those numbers down on paper becomes much, much easier.

3. A finance committee

We love a nonprofit committee! They help focus your efforts, bring enthusiasm and innovation, and save you valuable time and money. And a finance committee is one of the most important committees you can have because they do financial planning, stay on top of your budget, track overhead expenses, and generally keep your funds fundamentally favorable.

4. Nonprofit accounting software

This was one of our top tips, and it bears repeating. Just like you need nonprofit-specific software for donor management, fundraising events, and data management, you need nonprofit accounting software for activity tracking, budget management, and compliance management. The best accounting software for nonprofits are built for your specific needs as a nonprofit, so even if you don’t have a degree in accounting, you can learn to handle the basics.

5. Financial reporting and dashboards

Dashboards and reporting tools provide essential insights into all your financial data while presenting it in a clear and understandable format. With custom reporting, you can stay on top of every warning sign and make every decision with confidence.

Accounting may feel like magic, but with a little knowledge and the right tools, you can wave your wand (or dashboard) and embark on a journey to financial wizardry. With solid finances, you'll be unstoppable!

The critical element that brings nonprofit fundraising together: QuickBooks

Why do you need all these accounting tools? You're a nonprofit. You can just get one of your board members to make a spreadsheet, right?

Hard no.

As we already discussed, sound accounting practices build a healthy, compliant, transparent nonprofit that makes strategic decisions. Not only that, the secret to successful fundraising is fully functioning back-end management powered by a solid financial integration.

Lucky for you, Funraise, the best online fundraising platform, has the best integration with the best nonprofit accounting software: QuickBooks!

Fundraising is more than just sparkly galas and fun runs; it's serious business (and you know it!). When you realize the impact that fundraising can have on your nonprofit's mission, the choice to focus behind-the-scenes is a pretty simple one—and having the tools to make every fundraising campaign successful all the way to the bank is key to making your mission a reality.

Nonprofit accounting: Key takeaways

- Nonprofit accounting refers to tracking and managing financial activities to ensure organizational transparency and financial accountability.

- Sound accounting practices are crucial for nonprofits to maintain their financial health, stay on budget, and comply with legal and regulatory requirements.

- Nonprofit accounting differs from for-profit accounting by emphasizing accountability over profits and focusing on transparency and compliance with funding restrictions.

- There are four key financial statements for nonprofits: the statement of activities, statement of financial position, statement of cash flows, and statement of functional expenses.

- Nonprofit organizations have many options to help them effectively manage their finances. In particular, they should use nonprofit accounting software, invest in a great CRM, establish internal controls, consider professional accounting services, conduct regular audits, and use financial reporting tools and dashboards.

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)